As the world continues to become more digitised and interconnected, large enterprise commercial real estate faces a significant shift in how companies utilise office space. With hybrid offices becoming more commonplace and technology enabling greater flexibility, organisations are re-evaluating how they use their physical spaces to optimise productivity and efficiency.

In many ways, commercial real estate is a thriving industry that has experienced significant growth over the last few years. This sector includes office buildings, retail spaces, industrial facilities, and warehouses. With the rise of e-commerce and technological advancements, the demand for commercial properties has increased, leading to an influx of investment and development.

For large enterprises, however, there is a fear that the scales will tip the other way with rising inflation rates and banks withdrawing financial support. Here’s a breakdown of the pain points affecting businesses and how technology can support a return to growth.

A Problem For Growth

Over the last three years, the world has endured several crises that have affected economic growth and caused unprecedented changes in how we work. Corporations around the globe have traversed each new situation with a wary eye on market volatility, China-American relations, and at one time, a ship trapped in the Suez Canal. Although seemingly unrelated, each event has triggered a new crisis for businesses and financial institutions.

Boston Consulting Group has warned:

Global trade is slowing as the Ukraine conflict, and its consequences have replaced the pandemic as the leading drag on growth. Trade will grow at a slower average rate than GDP in the coming nine years, reversing the pattern of trade-led global growth that has prevailed in recent decades.

The BBC also reported on the impact of the Suez Canal blockage: “12% of global trade, around one million barrels of oil and roughly 8% of liquefied natural gas pass through the canal each day” and that “Lloyd’s List showed the stranded ship was holding up an estimated $9.6bn of trade along the waterway each day.” Business took another big hit, and it’s impossible to calculate the cost of one stranded ship in Egypt to the world’s economy.

Businesses are seeking ways to grow and optimise their existing assets in response to all this global turmoil – but many aren’t sure what they need to make this happen. CEOs and COOs are now turning to their buildings and employees.

Hybrid Office Evolution

Employees began demanding a better work-life balance after years of working from home and flexible working conditions during the pandemic. The ‘Great Resignation’ proved the seriousness of this new view of working. Hybrid, flexible, and remote working have become standard perks in most job advertisements, but businesses are still struggling to implement these operational policies—the issue: offices are empty.

Flexible workspaces have become an emerging solution. These new layouts allow companies to adjust their office space according to their needs, whether adding or reducing the required space. Flexible workspaces also offer a variety of amenities, such as meeting rooms, lounges and kitchens, which can help foster a sense of community and collaboration among employees.

Assets can drain resources, and with many employees now hybrid, office buildings need help to entice people into the office. The Guardian reports that the Monday to Friday occupancy rate across the UK is 29%, compared with pre-pandemic levels of 60-80%. Enterprise organisations have existing loans on office buildings, and banks may raise interest rates in response to rising inflation and the threat of a recession.

How to Build a Winning Workplace Strategy for 2023

Large commercial buildings such as those in Canary Wharf, La Défense in Paris and Frankfurt’s Bankenviertel are becoming liabilities for banks and investors as they struggle with rising costs and post-covid workplace changes. Lenders and investors have backed the commercial property sector with €1.5tn of debt in Europe alone. Due to increasing interest rates, European real estate value could drop by as much as 40% by the end of 2024.

Additionally, the collapse of Silicon Valley Bank (the most significant failure since 2008) and the UBS rescue of Credit Suisse have some worried the banks will curtail funding to the commercial property sector—a sector currently worth £16tn globally.

Because of rising interest rates, some owners of offices, shops and warehouses may be unable to refinance when existing loans mature, and could be forced to sell assets. – The Guardian.

Don’t Be Afraid To Innovate

“The so-called ‘remote work gap’ continues to widen across cities and income groups,” said Peter Lambert, a doctorate candidate at the London School of Economics. London, Manchester, and Bristol embracing remote and hybrid working roles show an appreciation for the shift in working since the pandemic; however, it also contributes to increasing commercial real estate anxieties.

The issue is driving a wedge between employers and employees, as some big names in trade and finance have begun demanding a return to the office full-time. But there is no need for enterprise offices to remain a drain on resources. There have been many success stories due to implementing workplace management solutions.

Data-driven office management is the solution everyone is looking for but needs help to implement. A better way to approach this change in employer and employee relations would be to measure and monitor space usage and adapt accordingly. If your office is busiest on Wednesdays – that’s the day to open office space up for meetings, creative brainstorming, target driven group analysis.

Smart building technology, for example, can help track energy usage, occupancy levels and air quality, allowing companies to make data-driven decisions about how they use their office spaces. This can result in significant cost savings and a more efficient use of resources.

Everything You Need to Know to Make Flexible Working Hours Work

Get Creative

Rather than trying to slowly haul employees back to the office one day at a time, employers will want to take a more strategic, evidence-based approach by utilising their people data to understand better how work gets done.- Forbes.

Fear should not be the driving force behind any organisation’s decisions, but we’re witnessing a toppling of innovation in favour of returning to the safety of outdated work models. Company culture and employee engagement don’t need to suffer for hybrid working to work.

Yet, these terms have become scapegoats for employers scuttling back to the total office work model. There is also little evidence that productivity suffers due to implementing a hybrid work model, another easy target for those seeking the traditional eagle-eye view of work output provided by conventional offices.

Often, these enterprises employ some of the greatest creative minds of the 21st century. Tearing down old models and building new ones is their bread and butter, but when it comes to using their real estate and managing their employees better, they seem determined to turn their backs on an exciting opportunity for change.

Stay Calm, And Optimise Real Estate

Although banks are looking to scale back their investment in commercial real estate potentially, that isn’t going to topple the economy. The Financial Times doesn’t think anyone needs to despair, reporting that:

In the UK, the consultancy Capital Economics said that four-fifths of loans were below a 60 per cent loan-to-value ratio — and that overall UK bank exposure to commercial real estate was half what it was in the run-up to the financial crisis.

The situation is unlikely to trigger a financial crisis. Corporations need to optimise existing office space for a hybrid work culture. Organisations must rethink their building model, embrace flexible hybrid working, and reinvigorate the market to improve occupancy rates. Resisting change and innovation rarely work in a business’s favour. The banks are withdrawing their investment because they aren’t seeing a solid response to building confidence in office real estate.

If these properties continue to drain resources, there will be forced selling from over-extended asset owners or debt funds, further reducing the value of assets and causing a downward spiral. To increase building occupancy, expand your workforce, encourage growth, and adapt to meet the future of work head-on – get excited, not scared!

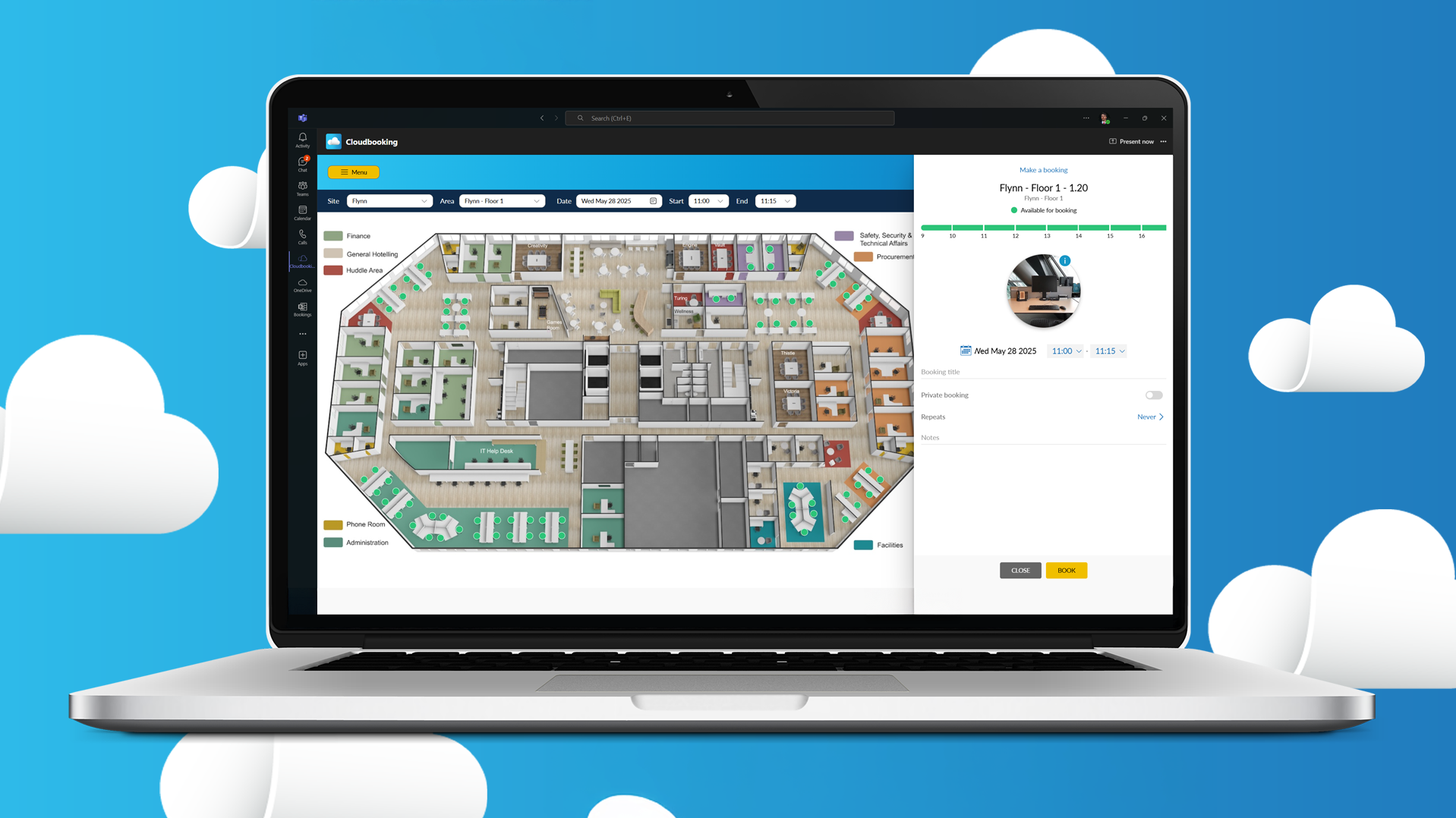

Cloudbooking has advocated for hybrid work models for a decade. We live in the technology age, but many must learn to use AI, VR, and data-driven management. Cloudbooking’s customisable hybrid work software and tools will support your business, your people, and your ever-evolving workplace to thrive with this technology.

Our Solution

The commercial real estate industry faces significant changes as companies adapt to new technologies and changing work patterns. By embracing flexible workspaces, smart building technology and hybrid models, businesses can optimise their office space and create a more productive and efficient work environment.

Monitor your office space with seamless integrations and view how employees use buildings to save money and encourage growth. Understand how your office works with our occupancy monitoring software, and increase efficiency and productivity with easy-to-use space and meeting-room booking.

New Cloudbooking Report Reveals 8 Key Findings on the State of the Hybrid Workplace

Create a social and productive space with our interactive colleague finder to promote collaboration and manage your office with our highly efficient and cost-effective digital signage option. Our easy-to-deploy QR codes can book desk spaces, and employees can check in/out quickly.

Contact Cloudbooking for a demo and learn more about how our office management software can optimise your real estate and transform your hybrid working policy.